PwC’s seven key trends impacting Qatar banking sector

2022 was a big year for Qatar. As host nation for the FIFA World Cup, Qatar found itself in unfamiliar territory in the global spotlight. The question is, how does the country maintain the momentum created by that sporting spectacle, how did its economy perform, and what long-term benefits can it expect?

A good barometer is financial performance, and PwC Middle East’s latest Qatar Banking Sector report highlights positive news when it comes to digital innovation, customer and data protection, data infrastructure establishment, and sustainability practices.

While banks globally have had to adjust to a period of high inflation and rising interest rates, those in Qatar have battled those headwinds and emerged with steady, healthy growth.

There has also been a shift towards new digital products and services as Qatar aims to position itself as a fintech hub. And one positive legacy of that World Cup has been a greater emphasis on sustainable finance initiatives, with Qatari banks embedding environmental, social, and governance (ESG) factors into their strategies.

“Qatar is strategically positioning itself as a leading FinTech hub in the Middle East and a pioneer in digital transformation and sustainability within the financial services sector,” said Ahmed Al Kiswani, Qatar Financial Services Sector Leader, PwC Middle East.

“We remain confident that the financial sector in Qatar is well placed to adapt to a changing financial environment and continue to grow.”

The 2022 edition of the PwC report identified six key trends for the banking sector in Qatar. For 2023, another theme has been added to that list.

“We believe these new trends will shape future direction and thinking in the banking sector and we are excited to witness how the system adapts and responds to new challenges,” added Al Kiswani.

PwC’s 7 key trends for the Qatar banking sector

New Lifestyle

Banks have made real advancements in customer experience and digital innovation, particularly during the FIFA World Cup 2022. They offer an enhanced banking experience to customers and partners, with seamless data and payment sharing.

New Values

Qatari banks have embraced ESG practices and are adopting sustainability measures. Leading banks have integrated ESG factors into their strategies and reporting, aligning with global frameworks and supporting green financing and social inclusion.

New Players

As the financial services landscape evolves, traditional banks have two choices – engage in fierce competition or adopt a strategic partnership approach. This will create new alliances in the banking sector.

New Technology

Qatar's digital transformation is making progress towards its National Vision 2030. Strategic initiatives like the Doha cloud region by Google Cloud and the implementation of OpenAI's GPT technology in the Azure Qatar Cloud are expected to empower Qatari companies with long-term benefits. However, banks must also consider risk mitigation and regulatory policies.

New Money

Not yet legalised in Qatar, cryptocurrencies face regulatory challenges. In addition, efforts to combat money laundering require strong controls and authorities to establish a robust regulatory framework.

New Rules

In the MENA region, supervisory efforts are focused on core banking activities, with initiatives aimed at customer and data protection, data infrastructure establishment, and promoting ESG practices. Qatar's regulators took proactive steps to strengthen the financial system and launched initiatives for sustainable finance, green finance, and fintech development.

Emergence of Non-Traditional Risks

Qatari banks have historically excelled in managing traditional credit risks, but they face challenges in effectively managing emerging non-traditional risks such as liquidity, cyber, and operational risks.

Established in the Middle East for 40 years, PwC has 22 offices across 12 countries in the region with around 6,400 employees.

- Qatar Airways: Who is new CEO and what are his priorities?Leadership & Strategy

- UAE's leading banks continue rollout of record-high resultsCorporate Finance

- PwC hits record revenue as Middle East and India lead growthCorporate Finance

- Lifetime of Achievement – Akbar Al Baker, CEO, Qatar AirwaysLeadership & Strategy

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

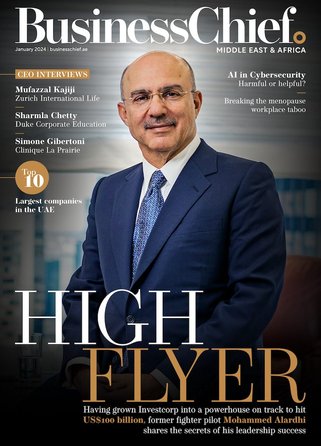

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy