UAE's leading banks continue rollout of record-high results

Growth for the UAE’s leading banks appears unstoppable, with the latest third-quarter financials continuing a roll-out of record-breaking profits.

The nation’s leading banks – which include First Abu Dhabi Bank (FAB), Emirates NBD and Abu Dhabi Commercial Bank (ADCB) – have hit new third-quarter profit records building on previous record 2023 quarters.

Driving this growth is a higher interest rate environment coupled with a growing appetite for new loans, as well as robust economic conditions in the UAE and wider region.

The country saw GDP growth of 3.8% in the first quarter of the year – boosted by the non-oil private sector, which has continued to see expansion throughout the year.

The UAE has “remained resilient in the face of global headwinds,” Ala’a Eraiqat, Group CEO of Abu Dhabi Commercial Bank (ADCB) said in the bank’s latest financial statement.

FAB delivers record performance for first nine months

As the country’s largest lender, First Abu Dhabi Bank beat estimates with a 46% jump in third-quarter net profit to AED4.3 billion (US$1.17 billion), delivering a record performance for the bank in the first nine months of 2023.

Net profit for nine months surged 54% YoY TO AED12.4 billion (US$3.38 billion), with revenue up 38%, reflecting the successful and sustained execution of the bank’s growth strategy.

In addition, Group revenue exceeded AED20 billion, while total assets reached AED1.2 trillion, marking a growth of 7% year-to-date.

“FAB’s reaffirmed superior credit ratings of AA-, our international and diversified franchise, our financial strength and ample liquidity, are among the distinct competitive strengths that position us well to continue our steady progress towards our strategic goals,” says Hana Al Rostamani, Group CEO.

Emirates NBD nine-month record high – surge of 92%

Dubai’s largest lender and the UAE’s second-largest, Emirates NBD saw third-quarter profit rise 38% YoY to AED5.2 billion (US$1.42 billion).

This takes the bank, which is majority-owned by the government of Dubai, to a new nine-month record high of AED17.5 billion (US$4.76bn) – which marks a whopping 92% hike on last year and reflects “the Group’s increasing regional presence and leading digital capabilities”, according to Hesham Abdulla Al Qassim, MD of Emirates NBD.

The Dubai lender has continued to gain traction on its digital platform adoption rates. As well a expanding it digital wealth platform to give customers access to more than 11,000 global equities, the bank enhanced its priority offer for UHNW customer, helping to drive 28% growth in AUM.

ADCB Q3 net profit surges

As the UAE’s third-largest lender, Abu Dhabi Commercial Bank reported a 22% increase in its third-quarter net profit to a record AED1.94 billion, which means that in the nine months through September, the bank’s net profit has risen 23.6% annually to AED 5.75 billion (US$1.57 billion).

The bank has also grown its assets by 7.8% to nearly AED537 billion (US$146 billion).

For ADCB, green bonds have become key to the bank’s funding strategy and its second issuance, a US$650 million green bond, was 2.9 times oversubscribed attracting more than U$1.9 billion in orders from local, regional and global investors.

Beyond the Big Three banks, Dubai-based Emirates Islamic Bank has seen a 56% growth in profit in the first nine months of the year to AED1.65 billion, with the latest quarter alone delivering income growth of 46%.

The bank’s Sukuk book size also reached a record AED10 billion, which marks the highest absolute value and the highest percentage of total assets to date, with total assets increasing to AED86 billion.

“We have seen growth across all our operating segments, including consumer, business and corporate banking segments, recently appointed CEO Farid Al Mulla said.

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

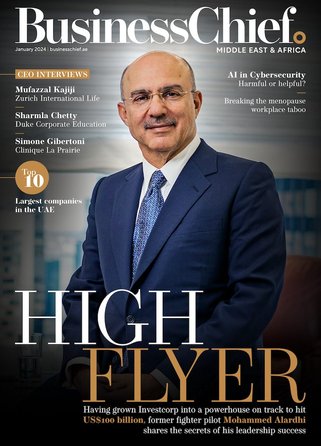

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy