PwC hits record revenue as Middle East and India lead growth

Cementing its reputation among the Big Four, PwC Global has reported record global revenue for its network of firms in 151 countries – while also investing in a record number of alliances, acquisitions, capabilities and people.

The UK-headquartered accounting and consultancy giant reported a 9.9% rise in revenue to a record US$53.1 billion for the 12 months ending 30 June 2023.

The UK, Middle East and India led global revenue growth, with the UK and Middle East seeing revenues rise 16%, while India proved the fastest growing large firm in the PwC network with a revenue rise of 24%.

Active in the Middle East for more than 40 years, PwC today has around 10,000 people operating from offices in 12 countries, including the UAE and Saudi.

In the Americas, which overall saw a 10.2% rise in revenues, Brazil led the growth with a 14.3% rise, while in Europe – Central and Eastern Europe also saw good growth of 15.2%.

While the numbers are up, revenue growth has slowed for PwC in FY24, down from 13.4% the previous year – and this has resulted in the company falling short of its Big Four rivals.

Competitors Deloitte and EY last month reported annual growth of 14.9% and 14.2%, respectively.

Despite this, all lines of the PwC business saw revenues grow, with tax and legal services securing its strongest growth in a decade.

This steady and sustainable growth comes as the Big Four firm continues to focus on investment in the lead-up to its 175th Anniversary in 2024.

“Our focus on delivering the quality services that our stakeholders need to prosper today and to prepare their organisations for the future has driven another year of growth for us,” Bob Mortiz, Global Chair of PwC said in a statement.

“As we come up to our 175th anniversary, we continue to invest in the future of our network with strategic acquisitions in key growth areas and a drive to expand our workforce and continue to acquire a broad and diverse range of talent.”

Increase in investments and acquisitions

Across the network of 151 firms, PwC invested US$3.7 billion during FY23, building on its previous year investments of more than US$3.1 billion.

Nearly US$2 billion is being invested to grow and scale AI capabilities, with the firm launching partnerships with multiple AI leaders and rolling out AI tools across all its lines of service.

In fact, PwC attributed the big growth in its tax and legal services, which secured the strongest growth for a decade, to the company’s investment in new alliances and capabilities especially in AI.

The firm completed 17 acquisitions and five strategic investments around the world in FY23, expanding its professional capabilities in a number of key area particularly in technology consulting, cloud and AI.

Building the workforce to match this has been a priority too and PwC added more than 36,000 new jobs over the last year.

On track to create 100,000 new jobs, two years early

This follows the creation of 32,000 new jobs the year before and means PwC is on target to reach its target of 100,000 net new jobs by 2026 – two years ahead of schedule.

Of the 100,000 new jobs being created, 6,000 are being added in the Middle East, marking a headcount over five years of more than one-third, with around 4,000 already added since 2021. This includes recruiting more than 500 graduates every year and a commitment to ensure half of all new intakes are women.

In its most recent graduate recruitment drive, 85% of PwC Middle East’s newly onboarded cohort of graduates Arabic speakers and close to half of them women.

Investment in training people has also upped, with the average amount of time spent on training a PwC person rising to 65.7 hours.

When it comes to other targets, the firm is on track to meet its net zero commitments and science-based targets, having secured a 61% reduction in scope 1 and 2 greenhouse gas emissions vs its FY19 baseline, and cut indirect scope 3 emissions from business travel by 49%.

Not just that, 18% of the firm’s purchased goods and services suppliers have set their own science-based targets and another 10% have committed to doing so in the future.

PwC Global – numbers to know

- Middle East revenues rose by 16% – 18% for continuing operations, marking the highest growth after India, which was the fastest-growing large firm in the PwC network with an increase of 24%

- The US saw revenues grow by 11.2%, while Canada lagged on 4.5% and Brazil posted the strongest revenue growth across the Americas, up 14.3%

- Across Africa, revenues grew more slowly, up just 4.1%, though South Africa put in a strong performance

- The assurance business grew 8.9% to US$18.7 billion, as the firm witnessed increased demand for assurance over a range of non-financial information, such as cyber and ESG disclosure.

The firm’s risk services business saw substantial growth, as both the geopolitical conflict and inflationary environment caused significant uncertainty for many businesses.

Advisory operations grew by 13%, driven by client demand for digital transformation.

The strongest growth came from tax and legal services, up by 12.5% to US$11.8 billion – the strongest growth for a decade, driven largely by client demand for help in boosting workforce productivity and employee experience and with help in dealing with increased tax and legal sustainability requirements.

- AI in cybersecurity: business strategy to boost resilienceTechnology

- Mira Murati: 10 things to know about the new CEO of OpenAILeadership & Strategy

- What are the top five consumer trends moving into 2024?Digital Strategy

- AI is changing the way we work and leaders must adapt – fastDigital Strategy

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

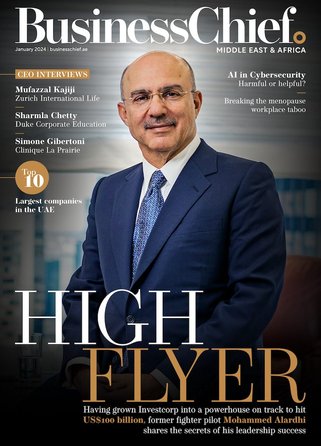

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy