Top five buy-now-pay-later fintechs in the Middle East

BNPL is having a moment in the Middle East.

The business model, which allows customers to pay for their purchases in instalments over a period of weeks or months, first emerged during the Covid-19 pandemic as e-commerce volumes soared.

Since then, the model has quickly established itself as a popular go-to financing option and is projected to hit US$565.8 billion in 2026, from an estimated US$309.2 billion in 2023.

Given BNPL’s popularity among younger consumers, the business model has soared in the Middle East, where 60% of the region is made up of people under 30 years of age.

Amid significant adoption by retailers and consumers regionally, BNPL firms were among the top-funded startups in 2022 in the Middle East and North Africa – and backing of this segment continues to be strong in 2023.

Take Tabby, the Dubai-founded BNPL platform, which has just hit unicorn status with a U$1.5 billion valuation – making it the Gulf region's first fintech unicorn.

This follows a Series D funding raise of US$200m led by US-based Wellington Management along with existing investors, PayPal Ventures and Abu Dhabi’s Mubadala.

Here, we take a deep dive into Tabby and four more BNPL companies making fintech waves in the MENA region.

1

Tabby

Founded in the UAE in 2019 by Hosam Arab (CEO) and Daniil Barkalov (COO), Tabby has grown rapidly to become the leading shopping and financial services app in the MENA region – with 10 million users, 30,000 brands (including 10 of the largest retail groups in the region) and more than US$6 billion in annualised transaction volume.

Recently raising US$200 million in equity financing, Tabby has become the Gulf region’s first fintech unicorn with a valuation of US$1.5 billion. Led by Wellington Management, one of the world’s leading independent investment management firms, the equity financing drew additional participation from growth equity investor Bluepool Capital, in addition to existing investors STV, Mubadala Investment Capital, PayPal Ventures and Arbor Ventures.

The funding is being used to continue advance "our mission across Saudi Arabia and the UAE" to reshape financial services, one that is fair and responsible, according to CEO and co-founder Arab. In September last year, Tabby announced it was relocating to Saudi Arabia as it looks to list on the Tadawul stock exchange.

One of the most valuable startups in the region, Tabby is the only startup in the GCC to receive funding from PayPal ventures.

2

Tamara

Since its launch in 2020 in Saudi Arabia, Tabby rival Tamara has onboarded six million customers, making it one of the largest shopping and payments platforms in the region – from Saudi to the UAE, Kuwait to Bahrain.

Acting as an e-commerce enabler for 15,000 merchants, including brands such as Shein, IKEA, Jarir, Noon and H&M, Tamara is among the highest funded startups in Saudi. Known for securing financing from top-tier global institutions, Tamara secured a debt facility of up to US$150 million from Goldman Sachs earlier this year, marking a regional first of its kind.

And in July, the startup was granted a permit by the Saudi Central Bank (SAMA) after completing a trial period in their Regulatory Sandbox. This allows Tamara to provide better solutions to customers and partner merchants.

Founded by Abdulmajeed Alsukhan (CEO), Turki Bin Zarah (COO), Abdulmohsen Albabtain (CPO), Tamara has more than 400 employees and operate out of its headquarters in Riyadh, with further offices in the UAE, Egypt, Germany and Vietnam.

3

Postpay

Co-founded in Dubai in 2019 by Tariq Sheikh and Dani Molina, Postpay has grown to 1.2 million monthly active customers, more than 1000 partnered retailers including Footlocker, Dermalogica and The Entertainer – and a return rate of 40%.

On a mission to "disrupt financial services by providing fair and accessible products to everyone", the startup has secured more than US$35m in funding from investors including Afterpay and Australia-based AP Ventures – and last year, received a debt financing deal from Commercial Bank of Dubai, enabling Postpay to expand throughout the GCC.

Now employing more than 100 workers across 10 countries, the leading omnichannel BNPL has seen its app downloaded 500,000 times.

4

Cashew

Founded in the UAE in 2020 by Ammar Afif and Ibtissam Ouassif, BNPL fintech Cashew Payments enables users to make purchases without using credit cards and gaining heavy interest charges.

To date, the fintech has raised US$41 million in investments including US$10 million from Mashreq Bank, with the bank integrating Cashew's platform into its payments subsidiary Neopay.

In addition, Shaker Group, Saudi's leading importer, manufacturer and distributor of ACs and home appliances, has acquired a 10% stake in Cashew for an undisclosed amount – with the aim of driving significant growth for both companies in the Kingdom.

As Cashew CEO Afif said: "With their support, we can build the infrastructure needed to meet the demand for digital lending solutions in the region's fastest-growing consumer market. Together we will enable Saudi consumers with a wide variety of digital lending products, and a financial management hub and provide a compelling user experience."

5

Spotii

Operating in key markets in the MENA region, including KSA, UAE and Bahrain, since 2020, Spotii was established as a direct-to-consumer BNPL service and has grown to a base of more than 1 million registered customers and 1,500 merchant partners. Founded by Anuscha Iqbal and Ziyaad Ahmed, Spotii had begun winding down its operations in the UAE, before announcing that it had acquired a BNPL licence from Saudi's central bank in June.

Initially acquired by Australia's publicly-listed Zip in 2021 for US$16.3 million, the BNPL startup was most recently snapped up by UAE-based fintech NymCard, which was founded in 2018 and is now the leading payments infrastructure provider in the MENA region.

The acquisition combines Spotii's leading technology, risk engine and market expertise with NymCard's powerful BaaS and Card Issuing platform, providing clients with a powerful solution to offer credit-on-demand products.

Ziyaad Ahmed points out that Spotii's unique services, such as Smart Expense Categorisation, Invoice Payment and Reconciliation, LLM driven Customer service and Collections app, instant credit decision ML model or smart OCRs "enables us to offer a range of value-added services that are unparalleled in the market".

- Why defending nature is vital to Middle East economic growthSustainability

- Top 10 biggest sovereign wealth funds in the Arabian GulfCorporate Finance

- What will drive the next round of dealmaking in Middle East?Corporate Finance

- IWG: Middle East expansion as hybrid work adoption growsHuman Capital

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

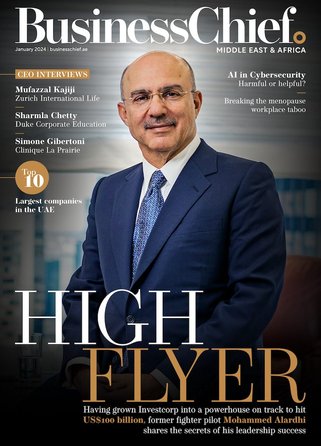

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy