Top 10 biggest sovereign wealth funds in the Arabian Gulf

The number of Sovereign Wealth Funds (SWFs) around the world has grown steadily over the past two decades, from 62 funds in 2000 to 176 in 2023, with assets under management ballooning from just a US$1 trillion to a staggering US$11.36 trillion.

While North America and Europe have their fair share of SWFs, Asia and the Middle East dominate – accounting for four-fifths of global assets.

For the oil-rich GCC countries, in particular, SWFs have become important tools to save for future generations, to help mitigate the impact of economic shocks, and increasingly, to aid diversification efforts away from oil and gas.

The Gulf countries are currently home to around 20 SWFs, and collectively manage close to US$4 trillion, according to the Sovereign Wealth Fund Institute (SWFI), the platform that studies more than 400 SWFs and public pension funds worldwide.

The top five Middle East funds deployed more than US$73 billion in 2022 alone, and have grown by 20% in the last two years, thanks largely to a rise in oil prices, and the IMF has predicted that Gulf producers could earn up to US$1.3 trillion in additional revenue through 2026.

Global SWF’s report finds that funds from the Middle East have more than doubled their investments in the west, including the US and Europe, to US$51.6 billion in 2022.

Regional SWFs have increasingly focused on making investments that have a positive impact and that can shape the global economy – with growing investments in tech solutions and in climate change, not to mention the global sports industry.

Here, we highlight the top 10 largest sovereign wealth funds in the Arabian Peninsula and look at how each is diversifying.

1

Abu Dhabi Investment Authority (ADIA)

Total assets: US$853 billion

Established in 1976, when Abu Dhabi was still in the early stages of its transformation, ADIA has grown to be a globally-diversified investment institution that invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long‑term value creation.

ADIA is unique in the list in that it only invests overseas.

As ADIA’s founding father, the late President of the UAE, Sheikh Khalifa bin Zayed Al Nahyan, said: “Our main objective is to advance the UAE and its citizens. We will invest the country’s income in pursuit of this goal and, in doing so, successfully build our nation.”

Earlier this year, there was a reshuffle of wealth fund leadership, with UAE President Mohamed bin Zayed Al Nahyan naming his brother Sheikh Tahnoun, head of ADQ, to chair ADIA.

ADIA’s diversified investment portfolio spans geographies – and includes more than two dozen asset classes and sub-categories, from equities and fixed income to hedge funds, real estate, private equity and infrastructure.

ADIA regularly reviews its approach to emerging global trends – foremost among these is climate change.

ADIA is a founding member of the One Planet Sovereign Wealth Fund Working Group, and helped to develop a framework to promote the integration of the climate change analysis into the management of large, long-term and diversified asset pools.

ADIA has significant investments in all of the world’s major markets, including 45-60% in North America and 15-30% in Europe – and is growing its portfolio in developing markets (emerging markets, 10-20%) and developed Asia 0.5-10%. To ensure geographic diversity, ADIA has a culturally diverse workforce, made up of more than 65 nationalities, with a global network of relationships with the world’s top investment institutions and thought leaders.

More recently, the wealth fund has been ramping up exposure to Asia, partnering with Singapore’s SC Capital Partners to target data cente investments across the Asia-Pacific region – and investing in Indian startups, acquiring stakes in MobiKwik (digital financial services platform) and Jaipur-based DealShare (a social e-commerce startup).

2

Kuwait Investment Authority

Total assets: US$803 billion

As well as being one of the world’s largest sovereign wealth funds (fifth globally), Kuwait Investment Authority (KIA) is the world’s oldest, having been established since 1953.

KIA is managed by its Board of Directors composed of the Minister of Finance (Chairman), the Minister of Oil, the Undersecretary of the Ministry of Finance and the Governor of the Central Bank, as well as five other Kuwaiti members specialised in various fields of investment.

As well as its headquarters in Kuwait City, KIA has international offices in Shanghai and in London, with its London-based Kuwait Investment Office recently witnessing a surge in AUM – reaching US$250 billion this year, up from US$27 billion in 2003.

Like many regional SWFs, KIA's mission is to provide an alternative to oil reserves by achieving long-term investment returns and ensuring the financial security of future generations in Kuwait.

KIA looks after both Kuwait’s General Reserve Fund (GRF) and its Future Generations Fund (FGF). The former is the main repository of all of the state’s oil revenues and consists primarily of investments in Kuwait and other MENA countries. The latter fund is Kuwait’s flagship investment fund and comprises investments outside Kuwait in various asset classes ranging from equities and bonds to private equity, real estate and infrastructure.

KIA's portfolios seek to deliver superior, long term, risk-adjusted returns, primarily through investments in high quality companies and projects. Its footprint has strategically grown over the past 65 years with assets covering the Americas, Europe, Asia-Pacific and Emerging Markets.

Among investments, KIA has stakes in biopharma companies in China, a stake in Mercedes-Benz, in India’s largest carmaker Maruti Suzuki and other Indian companies including CarTrade Tech and Suntech Realty – and recently acquired a 50% stake worth US$1.8 billion in refrigerated container lessor, SeaCube Container Leasing.

Like ADIA, KIA is a member of the One Planet SWF Initiative.

3

Public Investment Fund (PIF)

Total assets: US$776 billion

Claiming sixth spot on the global chart, with holdings of US$776.65 billion, PIF is the driving force behind the changing landscape of Saudi Arabia – having put in motion in 2021 a five-year strategy to more than double the value of its AUM to US$1.07 trillion by 2025 and to commit US$40 billion annually to develop the kingdom’s economy until 2025.

Mandated to pump US$40 billion to US$50 billion into the local economy annually to generate jobs and grow the non-oil economic base of the country, PIF has been working to diversify its funding sources.

As well as driving the kingdom’s giga-projects, most notably NEOM, Red Sea Project and developer ROSHN, PIF has made investments across industries, from renewable energy to telecoms to food production – and established 89 companies since 2017 focused on 13 strategic sectors to seek new investment opportunities and launch manufacturing facilities in the kingdom.

Among these, Halal Products Development Company which aims to localise the development of a wide range of halal products.

What's more, PIF has its sights set on emerging markets and has created a new unit to target investments in a number of Iraqi industries under newly formed Saudi-Iraqi Investment Company with a capital of US$3 billion.

Increasingly active in the global startup scene, too, the Saudi wealth fund has backed a growing list of US startups and is also focusing its attention on the Asia startup landscape. PIF joined Alibaba Group to raise funds to back tech startups in the ME and Asia, and is increasingly forming strategic partnerships to tap into Asia’ growth potential. Among these, a partnership with Singapore’s SWF to invest US$986 million in South Korea’s Kakao Entertainment Corp.

4

QIA Qatar Investment Authority

Total assets: US$475 billion

Established in 2005 to protect and grow Qatar’s financial assets, and to help diversify the economy, QIA is the wealth manager for the State of Qatar and ranks tenth largest SWF in the world.

As a global and diverse organisation, QIA’s investments span all major global markets, asset classes, sectors and geographies and its teams are comprised of more than 40 nationalities.

As one of the six founding members of the One Planet Sovereign Wealth Fund Group, QIA announced in 2020 that it will make no new investments in fossil fuels – and instead embarked on a strategic restructure. A new asset allocation approach and long-term investment plan was introduced to guide portfolio evolution.

CEO since 2018, Mansoor Ebrahim Al-Mahmoud has said that QIA is a long-term investor “focused on delivering sustainable returns”.

In January, QIA increased its stake in Credit Suisse to just under. 7% becoming the Swiss bank's second-largest investor – and more recently has been in talks with India's conglomerate Reliance to invest US$1 billion for a 1% stake in Reliance Retail Ventures.

QIA has also been investing in emerging markets, recently taking a stake in the Eurasia Tunnel company in Istanbul and with plans to invest US$5 billion in Iraq and having

In line with its ambition to support companies at the forefront of technological innovation, QIA has invested in numerous tech startups, including Indian companies Swiggy, Rebel Foods, VerSe Innovation and Flipkart – and joined a consortium led by Korea’s MBK Partners to invest US$1.2 billion in SK On, an EV battery manufacturer.

More recently, QIA led a Series D funding round for Builder.ai, the mobile development startup backed by Microsoft, upped its commitment to AI-powered marketing tech startup Insider, and joined a funding round along with AWS and Microsoft as a new investor in Databricks, a data and AI company.

“This investment is aligned with QIA’s investment approach to invest in forward-looking, tech-led companies, many of which are building AI seamlessly into their product and offering,” says Mohammed Al-Harden, Head of TMT investments at QIA.

5

Investment Corporation of Dubai (ICD)

Total assets: US$320 billion

Established in 2006, ICD is the principal investment arm of the Government of Dubai, supporting the long-term economic prosperity of Dubai and the objectives of the Government’s economic development strategy.

ICD, which owns Emirates airline, reported a five-fold surge in 2022 net profit as revenue rose by a record 58%.

ICD manages a broad portfolio of assets, both locally and internationally, spanning 58 investee companies, 87 countries and six continents, and a wide spectrum of sectors – from airlines to banks.

This not only reflects Dubai’s strategic focus areas and growth plans but affords diversification and risk minimisation, with banking (23%), transportation (25%), hospitality and leisure (18%), real estate and construction (15%) and retail (10%) making up the majority of investments.

Among major holdings, ICD’s portfolio companies include Emirates NBD, Commercial Bank of Dubai, Emirates Airline, dnata, ENOC, Dubai World Trade Centre, resort developer Kerzner International Holdings, Emaar, Dubai Airport Free Zone, ALEC, Dubai Duty Free, and DMCC.

In line with its long-term strategy, ICD has been increasing investments in sectors including fintech, life sciences, software and agritech, by partnering with sponsors who have deep sector expertise and like-minded investors.

Just last month, a new board of directors was appointed, with Sheikh Hamdan bin Mohammed, Crown Prince of Dubai, acting as chair, and Sheikh Maktoum bin Mohammed, First Deputy Ruler of Dubai, as vice chairman. Among other board directors, Sheikh Ahmed bin Saeed, CEO of Emirates Group and Helal Al Marri, director general of Dubai's Department of Economy and Tourism.

6

Mubadala Investment Company

Total assets: US$276 billion

Headquartered in Abu Dhabi and led by Mansour bin Zayed Al Nahyan, the brother of UAE President Mohamed bin Zayed Al Nahyan, Mubadala is a sovereign investor managing a diverse portfolio of assets in the UAE and overseas.

Commercially-focused, and described as a “sovereign invetor with an entrepreneurial mindset”, Mubadala deploys capital across its portfolio in promising geographies sectors that deliver competitive advantage, with industry sectors spanning healthcare, life sciences, renewables, utilities, financials, real estate, technology, materials and consumer.

Mubadala has built a prestigious portfolio in the UAE, among which sit companies such as leading lender First Abu Dhabi Bank, AI powerhouse G42, global tech ecosystem Hub71, Aldar Properties, Masdar City, and Yahsat along with several universities (Sorbonne Abu Dhabi, Zayed University) and hotels – think Rosewood Abu Dhabi.

In Europe, Mubadala has invested in British broadband provider CityFibre and acquired a stake in Scandinavian-based communications company GlobalConnect and is also the second-largest shareholder of luxury carmaker Aston Martin.

Among other strategic partnerships, Mubadala has forged an alliance with KKR Credit to tap into Asia’s growth potential, partnered with BlackRock to fund Tata Power Renewable Energy’s aggressive growth plans, and is co-leading a funding round for China’s Hasten Biopharmaceutic.

Tech startups are a focus too both in the region and globally, with investments in Saudi digital logistics platform Trukker, social media platform Telegram, Chinese EV company Xpeng and Chinese video sharing mobile app Kuaishou.

7

Abu Dhabi Developmental Holding Company (ADQ)

Total assets: US$157 billion

Incorporated in 2018, ADQ is one of the region's largest investment and holding companies mandated to accelerate the transformation of the Emirate into a knowledge-based economy.

ADQ contributes 22% to the emirate’s non-oil GDP.

“As an asset owner and a sustainable investor, ADQ seeks out compelling opportunities across economic clusters that are critical to realising Abu Dhabi’s economic vision, including Energy & Utilities, Food & Agriculture, Healthcare & Life Sciences and Mobility & Logistics."

That means many of its investments are focused on major enterprises within Abu Dhabi.

With more than 65,000 employees and over 25 portfolio companies, ADQ invests in sectors that are essential to the growth of the UAE, including energy and utilities, food and agriculture, healthcare and life sciences, mobility and logistics, financial services, sustainable manufacturing and tourism, entertainment and real estate.

Its portfolio includes leading Abu Dhabi-based companies such as Etihad Airways, Abu Dhabi Airports, Emirates Steel Arkan, integrated utilities company TAQA, waste management pioneer Tadweer, F&B company Agthia Group, leading hypermarket chain Lulu, the UAE’s largest healthcare provider Pure Health, and AD Ports Group, which operates 11 multi-purpose ports.

Regional startups are also a focus for ADQ and it has backed health-tech company Okadoc, and along with Mubadala and PIF-backed Riyad Taqnia Fund, has provided funding to Saudi logistics platform Trukker.

ADQ, which established an office in Cairo in December 2021, has also taken steps to up its investments in Egypt and support co-investment with The Sovereign Fund of Egypt (TSFE).

8

Emirates Investment Authority

Total assets: US$87 billion

Established in 2007 as the UAE’s sole federal wealth fund, Emirates Investment Authority (EIA) is mandated to strategically invest funds allocated by the Federal Government to create long-term value for the UAE.

EIA manages both the strategic assets of the UAE federal government, including Al Masraf Bank, Emirates Post and Emirates Transport, and the global endowment portfolio.

EIA has government stakes in more than 30 corporations across the GCC including industry regional players, with significant holdings in telecommunications companies Etisalat and Du and also in Gulf International Bank, United Arab Shipping Company and Gulf Investment Corporation.

The sovereign wealth fund has also awarded significant investment mandates to global asset managers. Operating in five regions and across 10 asset classes, EIA invests into a globally diversified investment portfolio that includes both developed and emerging markets.

The EIA is chaired by Sheikh Mansour Bin Zayed Al Nahyan, who was appointed UAE co-vice president alongside Sheikh Mohammed in March.

9

Oman Investment Authority (OIA)

US$20 billion

The sovereign wealth fund of Oman, OIA was established in 2020 following the merger of the Oman Investment Fund and the State General Reserve Fund.

Among OIA’s objectives, to finance the state’s general budget, to manage and develop the Sultanate’s funds and assets, to achieve financial reserves, and to implement government policies to advance the targeted economic sectors.

In 2022, OIA contributed more than OMR5 billion in state dividends to GDP and this year it has set out to spend US$4.9 billion on new investments projects.

In August, OIA released one of the most comprehensive discloures of any Middle Eastern SWF, reporting an 8.8% annual return and total AUM of US$46.6 billion in 2022, an increase of around 11%.

OIA has two portfolios – the National Development Portfolio, with 60% of assets that are domestically focused, including its national oil company OQ and Oman LNG – and the Future Generations Fund, with 40% of assets focused towards international holdings.

OIA invests in more than 50 countries worldwide across two main categories – public markets and private markets. The public market investments include global stocks, fixed-income bonds, and short-term assets, while private market investments are focused on real estate developments, logistics, service sector, mining, industrial projects, and technology companies.

Strategic joint ventures are a pillar of the OIA’s drive to support the government’s foreign partnerships, mostly with other SWFs. Bilateral ventures have been signed with Uzbekistan, Brunei, Vietnam, Qatar, Spain, Pakistan and India, with ventures totalling U$1.74 billion of investment commitments.

10

Mumtalakat

Total assets: US$18.2 billion

Established in 2006, Mumtalakat is the sovereign wealth fund of Bahrain – whose mission is to bring a disciplined and inquisitive mindset to each investment through “collaborative and active management of our portfolio of strategic assets and a balanced investment approach”.

Led by CEO HE Shaikh Abdulla bin Khalifa Al Khalifa, Mumtalakat’s portfolio comprises strategic investments, global asset management, local impact investments and government holdings.

Its Government Holdings portfolio includes government-run assets of national strategic importance, while local impact investments deliver investment in and for the Kingdom of Bahrain.

Among strategic investments in Bahrain, Mumtalakat’s portfolio companies include Bahrain Telecommunications Company, FAI Aviation Group, Envirogen Group, Gulf Hotels Group and the National Bank of Bahrain.

While outside of Bahrain, the wealth fund is most known for its acquisition of McLaren. In 2007, Mumtalakat acquired 30% of the UK-based Group, which runs the Formula One motor-racing team, and has more recently expanded its majority stake in McLaren.

Its diversified investment strategy encompasses a sector-agnostic approach, allowing Mumtalakat to target high-potential businesses. Along with diversity in geography comes diversity in sectors, including financial services, real estate and tourism, industrials, education, aviation, telecoms, media and technology, automotive.

- Why defending nature is vital to Middle East economic growthSustainability

- What will drive the next round of dealmaking in Middle East?Corporate Finance

- IWG: Middle East expansion as hybrid work adoption growsHuman Capital

- Why we should focus on risk management rather than ESGSustainability

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

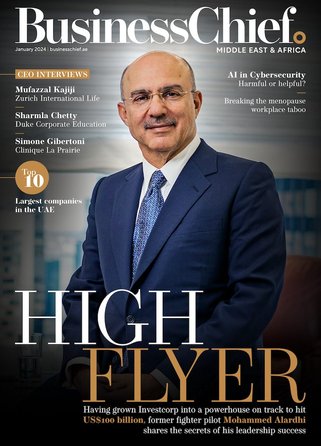

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy