Interview: Neeraj Gupta, CEO of Policybazaar UAE

There is no denying the rapid pace at which technology is transforming the financial industry.

The fintech sector, which currently holds a 2% share of the US$12.5 trillion in global financial services revenue, is estimated to grow sixfold from US$245 billion to US$1.5 trillion by 2030, according to a recent BCG report.

And while APAC is expected to become the largest fintech market by 2030, the MENA region is seeing rapid growth with fintech hubs emerging, adoption rates rising, and regional fintech startup funding quadrupling from US$200 million in 2020 to US$885 million in 2022, McKinsey research finds.

And despite global market fluctuations, MENA fintechs continue to expand with revenue projected to almost triple from US$1.5 billion in 2022 to between US$3.5 billion to US$4.5 billion by 2025.

Compared to fintech, the insurtech sector has seen slower growth regionally, making it ripe for the taking with expected growth at a CAGR of more than 6% between 2019 and 2028, according to a report by Mordor Intelligence.

Tapping into the region’s growth potential is insurtech major Policybazaar. Born in India in 2008 with a mission to bring transparency to the insurance industry, the company has grown to become India’s largest online marketplace with a 93.4% market share and more than 19 million policies sold since inception.

Policybazaar chose the UAE as its first overseas market, setting up shop in the emirates in 2018 – and has since grown rapidly, becoming the leading insurance and advisory platform and largest insurance aggregator in the UAE.

Led by CEO Neeraj Gupta, who previously headed the motor insurance business for the parent venture in India, Policybazaar is an online financial marketplace offering insurance and personal finance products for individuals and businesses and is revolutionising the way the UAE thinks about buying insurance on the retail side.

“The market, which was fragmented and largely offline, is now taking big strides towards moving online,” Neeraj tells Business Chief. “The UAE market is growing rapidly, and Policybazaar is well-positioned to capitalise on this growth.”

Here, we sit down with Neeraj to discuss how technology is transforming the financial industry, the opportunities and challenges for fintech and insurtech in the UAE, and the main trends in digital banking.

Neeraj, prior to joining Policybazaar in 2011, you held roles at Wipro and Infosys. How did these prepare you to lead Policybazaar?

Wipro and Infosys are both mega organisations in market size and employee strength and global leaders in the IT industry and I really wouldn’t be here if not for what I learned there. I had the opportunity to work on a variety of complex and challenging projects, experience that gave me the skills and knowledge I need to lead a large and complex organisation like Policybazaar.

Also, both IT majors are known for their strong customer focus, and I learned how to build and maintain relationships with customers and deliver products and services to meet their needs. This experience is essential in my role at Policybazaar, where customer satisfaction is our top priority.

Finally, both are committed to innovation and so I learned how to develop new ideas and solutions and how to bring them to market quickly and efficiently. This is important in my role at Policybazaar, where we are constantly looking for new ways to improve our products and services to meet customer needs.

How would you describe your leadership style and how has this evolved?

My leadership style is collaborative, transparent and empowering.

When I first started out, I was more focused on giving directions and telling people what to do, but over time, I have learned that it is more effective to be a collaborative leader and to empower my team. I believe the best way to lead is to create an environment where everyone feels valued and respected and has the opportunity to contribute and grow.

But to be that person, it was important for me to build a strong and cohesive team – aligned with my vision and that of the organisation. It took me time but I believe today that Policybazaar.ae has the strongest team amongst aggregators in the UAE. Each member knows their individual role and the part they play in group tasks – this makes my life easier as a leader and enables me to develop and execute a vision for the organisation, to identify and mitigate risks, and to make informed decisions.

I encourage input from my team members prior to making decisions and I’m always open to new ideas and suggestions. I also believe it’s important to be transparent with my team, keeping them informed of the company goals and strategies and sharing information about our performance and challenges.

Tell us about Policybazaar’s growth in the UAE – how is in the insurance sector changing here?

We have come a long way in a short time. We launched Policybazaar.ae in 2018 with a simple mission, to make it easier for people to compare and buy insurance online. Since then, we have grown rapidly, becoming one of the largest go-to platforms for insurance shoppers in the UAE.

We have always been at the forefront of the digital insurance revolution and we were the first insurance aggregator in the UAE. We have changed the way the UAE thinks about buying insurance on the retail side, making the sector more transparent, accessible, and affordable – providing innovative features and tools to help customers make informed decision about their insurance needs.

With Policybazaar, customers can compare quotes from all of the leading insurers in the UAE in a matter of minutes and thanks to partnerships with leading insurers in the emirates, customers can secure exclusive discounts and promotions.

We chose the UAE as our first overseas market for various reasons. As well as being a major insurance market with a high penetration rate, meaning a large pool of potential customers already comfortable with the concept of insurance, the UAE is a relatively technologically advanced country with a high internet penetration rate. Also, the country has a diverse population with a wide range of insurance needs, and a high density of Indian diaspora – making it easier for us to launch here.

Among valuable lessons learned in setting up here, a strong understanding of the local regulatory environment is important, as is the need to tailor marketing and sales strategies to the local culture and language.

We see the UAE and wider Middle East region as a major growth market for the company and plan to continue to invest in the UAE and grow our size here before we look at other regional markets.

What are the opportunities and challenges in the UAE fintech and insurtech landscape?

The fintech, insurtech landscape in the MENA region is rapidly evolving, with the UAE at the forefront of this development. As well as having a young and tech-savvy population, the UAE has a well-developed financial infrastructure – and the UAE government is committed to becoming a global hub for financial technology and has been supportive in developing the necessary infrastructure and regulatory framework.

Blockchain is now being used to develop new financial products and services and to improve efficiency and security of existing financial processes; AI and ML are being used to improve the customer experience with banks developing chatbots; and Regtech companies are developing software solutions to help financial institutions to identify and manage risks, and to report on their compliance with regulations.

We are also seeing fintechs and insurtechs developing new and innovative financial products and services tailored to the needs of the MENA region along with the expansion of financial services to underserved populations – from fintechs developing mobile payment solutions and peer-to-peer lending platforms to insurtechs developing micro-insurance products that are affordable for low-income individuals.

Technology is making financial services more accessible, affordable, secure and innovative.

There are challenges too. The UAE does not have a unified regulatory framework for fintech and insurtech companies, which can make it difficult to operate and to raise capital, and there is also a shortage of skilled talent in these industries here, making it difficult to grow these businesses. However, the government is actively engaging with multiple bodies to overcome these.

The Dubai Financial Services Authority has launched a regulatory sandbox that allows fintechs to test new products and services in a controlled environment, the ADGM has launched a hub providing fintechs with access to resources and support, and the UAE Central Bank is working with fintechs to develop a central bank digital currency.

What are the main trends in digital banking right now?

There are three trends that are keeping most banks and fintechs awake – rise of mobile banking, the use of artificial intelligence (AI) and machine learning (ML), and Open Banking.

Mobile banking is becoming increasingly popular, as more people use their smartphones to manage their finances and banks are responding with the development of innovative mobile banking apps offering a wide range of features and services. AI and ML are being used to improve customer experience in digital banking, while Open Banking – a new regulatory framework that allows banks to share customer data with third-party providers – is creating new opportunities for banks to partner with fintechs to offer new and innovative products and services.

The future of embedded finance is looking very promising, but remains a wait-and-watch game, as more companies come to understand it and build the right partnerships that help their customers.

******

For more business insights, check out the latest edition of Business Chief Middle East & Africa and be sure to follow us on LinkedIn and Twitter.

You may also be interested in the Business Chief Asia and ANZ website.

BizClik is a global provider of B2B digital media platforms that cover executive communities for CEOs, CFOs and CMOs, as well as leaders in Sustainability, Procurement & Supply Chain, Technology & AI, Cyber, FinTech & InsurTech. We also cover industries including Manufacturing, Mining, Energy, EV, Construction, Healthcare and Food & Drink.

BizClik, based in London, Dubai, Singapore and New York, offers services such as content creation, advertising and sponsorship solutions, webinars and events.

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

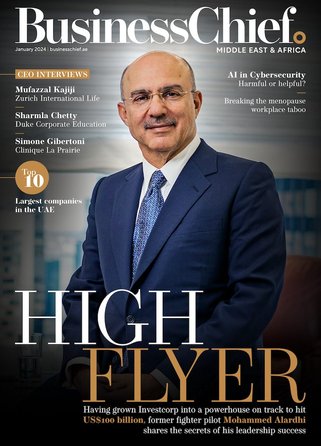

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy