Why we should focus on risk management rather than ESG

When it comes to ESG, there are few people who do not have a strong opinion, and that makes the very term divisive. However, that should not stop business leaders from embracing ESG principles and increased reporting – as their own sustainability as a business depends upon it.

So says Luma Saqqaf, CEO of Ajyal Sustainability Consulting, who believes that as the ESG backlash grows, it doesn’t mean ESG reporting in the wider context can be taken lightly – due to changing regulations and far-reaching changes in market behaviour.

Those unfamiliar with this ESG backlash only have to look to the United States. Back in March, 19 state governors issued a statement slamming President Biden’s ESG agenda.

That statement said: “The proliferation of ESG throughout America is a direct threat to the American economy, individual economic freedom, and our way of life, putting investment decisions in the hands of the woke mob to bypass the ballot box and inject political ideology into investment decisions, corporate governance, and the everyday economy.”

Clearly, passions are running high – not just in the US. So how is this impacting the Middle East & Africa, as the UAE prepares to host COP28?

Middle East companies need to embrace ESG reporting

“As much as we are seeing in ESG retrenchment we are equally seeing strong movement towards it,” says Luma.

“International companies that remain committed to sustainability are already putting pressure on, and engaging with, their value chain counterparties on sustainability and ESG matters. We are seeing that our clients in the Middle East are being expressly told by international organisations that if they pay more attention to ESG issues, in particular climate, they are more likely to get increased business.”

Many countries – including the EU block, UK, Singapore and many others – have some form of ESG disclosure requirements on specific types of companies. The EU’s Corporate Sustainability Reporting Directive (CSRD) is expected to force more than 10,000 non-EU companies to step up their sustainability reporting in order to do business in the bloc.

Luma says the need for ESG reporting is only going to increase. The International Sustainability Standards Board’s inaugural sustainability and climate standards were rolled out a few months ago with the stated aim of “creating a common language” that companies across the world can adhere to. Various countries have committed to adopt them and a few others are considering that shortly. Once adopted by countries, they are expected to have a significant impact on the streamlining of disclosures globally.

Consumers driving ESG agenda and business behaviour

“Another thing that cannot be ignored is that consumer and indeed market behaviour is changing rapidly – making profound changes to products and spurring developments of new technologies in particular in climate-related areas,” says Luma.

“So even if a company does not believe in climate change or the significance of ESG they must assess the impact on their business and consider whether a shift in their model is required to adapt and capture the potential opportunities they create.”

Luma suggests that there may be too much of a focus on the term ‘ESG’ to the point that the acronym is becoming a distraction and stalling important progress.

“At the end of the day, the essence of all this is regulatory compliance and risk management,” she says. “Whether you call it ESG, and the hotly contested debate around it, is less important. The unavoidable fact is that the market is changing and those who don’t risk being left behind.”

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

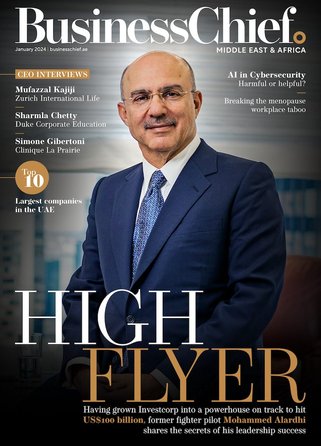

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy