How UAE unicorn Yalla Group is reaching ever-greater heights

In just seven short years, Yalla Group has witnessed exponential growth.

As well as seeing unprecedented expansion in subscriber numbers for its flagship product Yalla, becoming the first UAE-based tech company to list on the NYSE in 2020, the social networking and gaming group continues to hit new financial milestones.

The latest milestone sees the Dubai-based group break the US$152.8 million mark in the first half of 2023, an increase of 2.9% compared to the first half of last year, while net income reached US$48.2 million, marking a 26.6% increase.

Yalla Group has also seen a 14.3% YoY increase in monthly active users, reaching 34.2 million, and a significant 26.6% YoY rise in paying users to 13.4 million.

This strong performance comes as the Middle East continues its rapid digital transformation, with momentum arising from the recognition that the region’s market opportunity may be strategically significant for global internet giants, according to Yalla’s founder and CEO Yang Tao – as well as from the support given by the local MENA government.

The UAE digital economy’s contribution to GDP in 2022 reached 9.7%, up 4.3% from 2019, with plans to reach 19.4% within a decade.

Yalla’s rise – value of localised appeal

Yalla Group is no stranger to strong performances, however. As the MENA region’s largest social networking and gaming company, the Group has continued to break subscriber and financial records since its inception in 2016.

Launching in Dubai’s Internet City with flagship product Yalla, the tech firm quickly saw growth in subscribers, achieving unicorn status within just a few years, and becoming the first UAE-based tech company to list on the New York Stock Exchange in 2020.

Among reasons for its climb to become the leading voice-centric platform in the MENA region, Yalla is specifically tailored for the people and local cultures of the region, with its flagship mobile application primarily featuring Yalla rooms – a reimagined online version of the majlis or cafes where people spend their leisure time in casual chats.

In 2021, Yalla Group’s revenue jumped over 102%, and in 2022, was up 11% from the previous year – and in the last three years, the Group has been recognised as one of the top 30 EMEA-headquartered publishers by worldwide consumer spend by data.ai.

While flagship product Yalla, aka the ‘Clubhouse of the Middle East’, clinched the number one spot as the highest revenue-generating voice-centric social networking and entertainment platform in the MENA region, the Group's second product, mobile gaming app Yalla Ludo, topped the charts as the number one revenue-generating tabletop application on iOS and Google Play in the region – and in the entire world.

Like Yalla, Yalla Ludo has paid close attention to detail and the offer of localised appeal which deeply resonates with users. The app delivers online versions of board games that are popular in the region like Ludo and Domino – inclusive of in-game real-time chats and Ludo chat room functions and for its innovation has secured numerous awawrds, including the Gold Award at the MENA region Stevie Awards in 2022.

As President of Yalla Group, Saifi Ismail, said at the time: “Yalla is proud to drive innovation and advance MENA’s digital development [and] we will spare no effort to harness all of our capabilities and resources as we work to become the No. 1 platform for social networking and online entertainment in the region.”

Looking to the future – pivot to gaming

With Ludo and more recent gaming announcements, Yalla looks to be slanting from chatting services to gaming.

The Group recently launched its proprietary hard-core role-playing game, Age of Legends, a fantasy with roots in Arabic culture, set against a landscape of oases, snowfields and deserts; while a simulation game, Merge Kingdom, is soon to follow.

Both games are part of Yalla’s strategy of moving beyond its signature focus on casual games to target more serious players – where the money is.

The Group continues to spend on R&D and has increased its spending on tech and product development, which it can do thanks largely to its sustainable financials which includes almost zero debt, and cash or cash equivalents of US$435.6 million, up 7.0% from the end of 2022.

To continue its focus on growing sustainably, the tech firm recently established a Sustainable Account for Cash Management with Standard Chartered.

“As MENA continues to develop rapidly, we will leverage our deep local insights to broaden our business horizons and incorporate sustainable practices company-wise,” says CEO Yang Tao. “Ensuring that our cash management procedures contribute to enhancing sustainability throughout the local and international economies reflects Yalla’s overall direction as well as our profound commitment to the MENA region.”

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

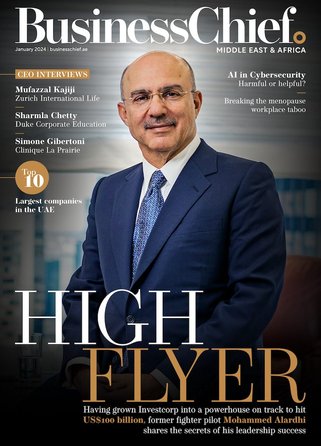

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy