Why every CEO needs to wake up to the green finance dream

If you think green finance is window dressing for companies looking to bolster their sustainability credentials – this article is not for you.

If, however, you agree with PwC that green finance will be a US$2 trillion market in the Middle East alone, and US$22 trillion globally by 2030 – read on.

The facts are clear. Green finance is growing quicker in this region than anywhere else, although admittedly it accounts for a relatively small percentage of the global total. That is sure to change.

In July, Abu Dhabi-based renewable energy company Masdar concluded a US$750 million green bond issuance that was 5.6 times oversubscribed. Those finds will help Masdar develop renewable projects in developing countries and those most at risk from climate change.

That cause is close to the heart of Masdar’s Chairman Sultan Al-Jaber, who also happens to be the UAE Minister of Industry and Advanced Technology, as well as President-Designate for the upcoming COP28 being held this month in the UAE.

“It is vital to make finance more available, accessible and affordable for developing economies if we have any chance of meeting climate goals to supercharge sustainable development,” said Al-Jaber.

“Ahead of the UAE hosting the UN climate change conference, we must champion initiatives that advance climate finance and decarbonisation.”

Financial institutions are also leading by example, including First Abu Dhabi Bank (FAB) – the UAE’s largest by assets and the first in the MENA region to issue a public green bond in March 2022. FAB aims to disburse US$75 billion in green finance by 2030, and facilitated US$9 billion of sustainable projects last year alone.

Shargiil Bashir is the EVP and Chief Sustainability Officer at FAB, and he believes every CEO should be taking green finance seriously.

“Green finance is or should be an active concern to CEOs, given its potential to significantly impact a company’s financial performance, its access to capital, risk management, sustainability goals, reputation, regulatory compliance and stakeholder relationships,” Bashir tells Business Chief.

“If we focus on sustainability goals, green finance directly aligns with these targets and it is every CEO’s responsibility to ensure that their companies are on track to meet these goals.”

Bashir highlights five key reasons why green finance is good for business: improving environmental performance, meeting investor and stakeholder expectations, risk management, regulatory compliance, and access to capital.

Jose Maria Ortiz, is co-CEO and Head of Impact Investing at The Palladium Group – a global impact firm that works with corporations, governments, investors, communities and civil society in 90 countries, and has corporate offices in Dubai, Riyadh, Nairobi and Abuja.

“CEOs should be delighted with the opportunity to tap into these resources to finance growth and transformation of their companies,” says Ortiz. “Now, CEOs can prepare interventions to decarbonise their value chain, launch new products and services that appeal to the green finance market, launch new facilities, and tap into cheaper capital.

“Only CEOs that work in highly polluting industries and do not have the imagination or the capacity to launch green initiatives should be worried about the advantage that more innovative competitors will have by using that cheaper green capital.”

And there is plenty of that green capital around – growing more than 100 times in the last decade, according to Bashir.

“Global borrowing by issuing green bonds and loans, and equity funding through initial public offerings targeting green projects, swelled to US$540.6 billion in 2021 from US$5.2 billion in 2012,” he adds.

“The Middle East and North Africa’s green finance market is moving towards the mainstream, with total issuance jumping by 122% in 2021 compared to 2020. The issuance in the region also outpaced global growth, although the market continues to account for a small fraction of global volumes.”

Green finance in MENA region in growth

Let’s put those figures into perspective. Bashir says green and sustainability-linked debt issuance in the MENA region reached US$18.6 billion in 2021, up from US$4.5 billion in 2020. Clearly, that is significant growth, but dwarfed by the three biggest green bond issuing countries – China with US$85 billion, the US with US$64 billion, and Germany with US$61 billion, according to Statista.

“Developing countries are lagging although they have a critical role and impact on climate change,” adds Bashir. “Achieving the transition to net-zero emissions by 2050 requires substantial climate mitigation investment in emerging markets and developing economies, which currently emit around two-thirds of greenhouse gases.”

Since FAB issued the region’s first green bond, they have completed 14 more, and other banks from the region have taken note and followed the example set.

“We are now seeing issuance growing as more participants enter the market, including Riyad Bank, Abu Dhabi Commercial Bank, Dubai Islamic Bank, National Bank of Kuwait, and Qatar National Bank.”

Ortiz adds that the Middle East and its oil-dependent economies have taken a longer time to develop the market. However, he says there is a clear objective to lead – with the UAE and Saudi Arabia showing the way forward.

“[Middle East countries] will need more time than Europe and the US to fully embrace the concept, understand its importance and develop products that are credible to international investors,” says Ortiz.

“However, they have the tailwinds of their sovereign funds to create scale quite quickly.”

When it comes to the biggest challenges facing green finance, Ortiz says the very word ‘green’ can create confusion, and could actually erode investor confidence. He says investors are already talking about ‘dark green’ to differentiate from “less green products that have the label but not the substance”.

“If we solve the challenge ahead, the green finance market will continue to grow much faster than the rest of the market and the returns will be higher as the cost of capital will be lower,” adds Ortiz.

“The beauty of green finance is that it transcends sector and geography. The options are so vast in theme, geography and risk return that it caters to both impact and mainstream investors. With a US$30+ trillion market for green finance, the possibilities are endless.”

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

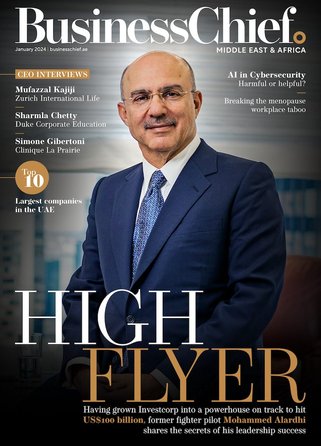

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy