How Saudi Arabia is building a global manufacturing hub

Last month, leading global tyre manufacturer Pirelli announced a joint venture with Saudi Arabia’s sovereign wealth fund PIF to build a tyre manufacturing facility in the Kingdom.

Expected to fire up production in 2026, the US$550 million joint venture will manufacture high-quality tyres for passenger vehicles, under the Pirelli brand, as well as manufacture and market tyres under a new local brand targeting the domestic and regional market.

The plant is expected to generate an annual production capacity of 3.5 million units.

For Pirelli, this provides access to one of the most promising markets in the world, while for Saudi, it marks a pivotal milestone in its journey to localise manufacturing capabilities – as part of its Vision 2030 Strategy to diversify the economy and enhance sustainability.

Pirelli’s commitment to Saudi marks the latest in a growing list of multinationals, from Hyundai to Lucid Motors, Schneider Electric to Emerson, announcing investment in production facilities in Saudi in 2023 – as the Kingdom accelerates its goal to become a global hub for global manufacturing.

Bold ambition to be a global manufacturing hub

First announced in October 2022, Saudi’s National Industry Strategy aims to triple the manufacturing sector’s contribution to GDP to more than US$238 billion and double non-oil industrial exports to US$149 billion by 2030.

The number of factories in the Kingdom is expected to triple by 2035 and additional investment in the sector could reach U$345.9 billion.

Certainly, Saudi is seeing a rapid expansion of its industrial base with the number of factories reaching 10,518 in 2022, compared to 8,499 operational units recorded a year earlier, according to the Ministry of Industry and Mineral Resources.

Foreign investment in the Kingdom’s industrial sector increased by 0.3% and joint ventures between local and foreign investors stood at 8%.

Growth in non-oil business activity including in manufacturing in Saudi accelerated in October 2023 for a second consecutive month, with the Riyadh Bank Saudi Arabia Purchasing Managers’ Index rising to 58.4 in October from 57.2 in September, far above the 50-mark, denoting growth the highest reading since June.

Push to develop Saudi automotive industry

Among the manufacturing sectors targeted for growth, the automotive industry is seeing particular focus (and traction), as the Kingdom looks to build a domestic EV market – supporting Saudi Green Initiative’s imperative to ensure 30% of new car sales in the country are electric by 2030.

PIF is behind much of this car manufacturing movement, having launched the Kingdom’s first national EV brand Ceer in November last year and more recently unveiling the National Automotive and Mobility Investment company, or Tasaru Mobility Investments, to boost localised automotive supply chains and manufacturing capabilities.

As well as partnering with Pirelli, PIF has established multiple partnerships with multinational carmakers – including Hyundai and Lucid Motors.

Last month, following an investment by PIF, electric carmaker Lucid Motors opened its first international manufacturing plant in Saudi, marking the country’s first car manufacturing plant. The facility will build Lucid’s award-winning EVs for Saudi and export to other markets, with plans to produce 155,000 cars a year by 2050.

And just this month, PIF and Hyundai Motor Company announced a landmark US$500 million joint venture to establish a state-of-the-art automotive manufacturing plant in KSA. The factory will produce vehicles with both electric and internal-combustion engines and is expected to begin production in 2026, with a target of 50,000 units per years.

Emerson and Schneider Electric expand local capabilities

As more multinationals make their manufacturing debut in Saudi, more technology companies are expanding their production operations to help facilitate the rapid expansion in local manufacturing.

In January, global technology, software and engineering powerhouse Emerson announced plans to build an innovation and manufacturing hub at the King Salman Energy Park (SPARK) in Saudi.

Slated to open by December 2024, the facility will mark one of the largest investments in the MEA region, providing industrial customers with services for control systems engineering, staging and testing, manufacturing of differential pressure transmitters and control valves.

Emerson is pursuing value chain localisation as part of the Made in KSA initiative and has targeted supply chain localisation opportunities across its various products, to ensure sustainability and elf-sufficiency of its facilities in Saudi.

“The new facility is positioned to offer our range of services to customers, while also supporting the company’s net zero emission targets,” says Vidya Ramnath, President of Emerson Middle East and Africa.

And back in June, Schneider Electric opened a brand-new production line in Riyadh to manufacture hardware to contribute to Saudi’s energy efficiency and sustainability. The company first established a factory in Riyadh in 1987.

Equipped with the latest automation technology and robotics, the new production line will produce Schneider Electric’s intelligent Altivar Process Modular Drives for use in industrial processes, machines, or building energy efficiency with each unit carrying the Made in KSA tag – part of the Saudi plan to position itself as a global exporter of intelligent digital products.

Mohamed Shaheen, Cluster President of Saudi Arabia and Yemen, Schneider Electric said: “As a leader in energy management and digital transformation, Schneider Electric’s new manufacturing line will produce intelligent equipment that can empower companies to become more energy efficient, and fulfil their decarbonisation and sustainability journey. It underscores our commitment to contribute to the Kingdom’s aims of tripling industrial output and strengthening its position as a global manufacturing base in line with Saudi Vision 2030.”

Featured Articles

SAP has announced it has appointed a new President for a newly-created EMEA region, aiming to make the most of the opportunities of cloud and AI

technology

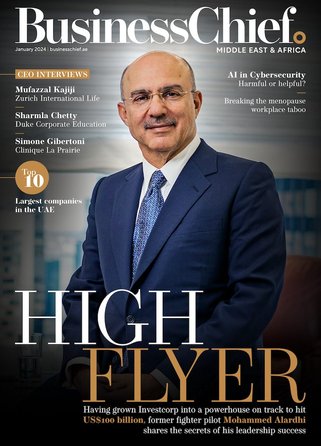

From fighter pilot to fashion house financier, Mohammed Alardhi has taken Investcorp to great heights – so what’s the secret to his success?

Dr Omar Al-Attas, Head of Environmental Protection and Regeneration at Red Sea Global, shares his COP28 hopes and approach to regenerative tourism

strategy